MarketingAdviser is a dedicated digital agency specialising in marketing and financial lead generation for IFAs, financial planners and wealth managers.

With over a decade of experience, we can run the results-driven campaigns you need to generate new leads for your firm.

Fill out the adjacent form and:

Receive a thorough analysis of your financial marketing to date.

Get free, expert advice about financial lead generation from an experienced consultant.

Gain fresh insights for your financial marketing plan going forward.

MarketingAdviser specialises in financial lead generation for IFAs, wealth managers and financial planners in the UK. If you are looking to expand your client base, then our team is at hand.

In particular, we specialise in financial lead generation concerning pension transfer leads, final salary leads, defined contribution leads, personal/private pension leads, and stakeholder pension leads.

Whether you require solutions which engage your existing client base for repeat business, or marketing solutions which connect you with new prospects, we can assist. Fill out our form to book a free consultation regarding our lead generation services.

Most IFAs, wealth manager and financial planners need a steady volume of qualified leads coming in every month. We can tailor a package which suits your budget and needs.

We can target my location to generate pension leads for your business. Whether you’re a franchise covering multiple regions or an IFA focusing on a local area, we can assist.

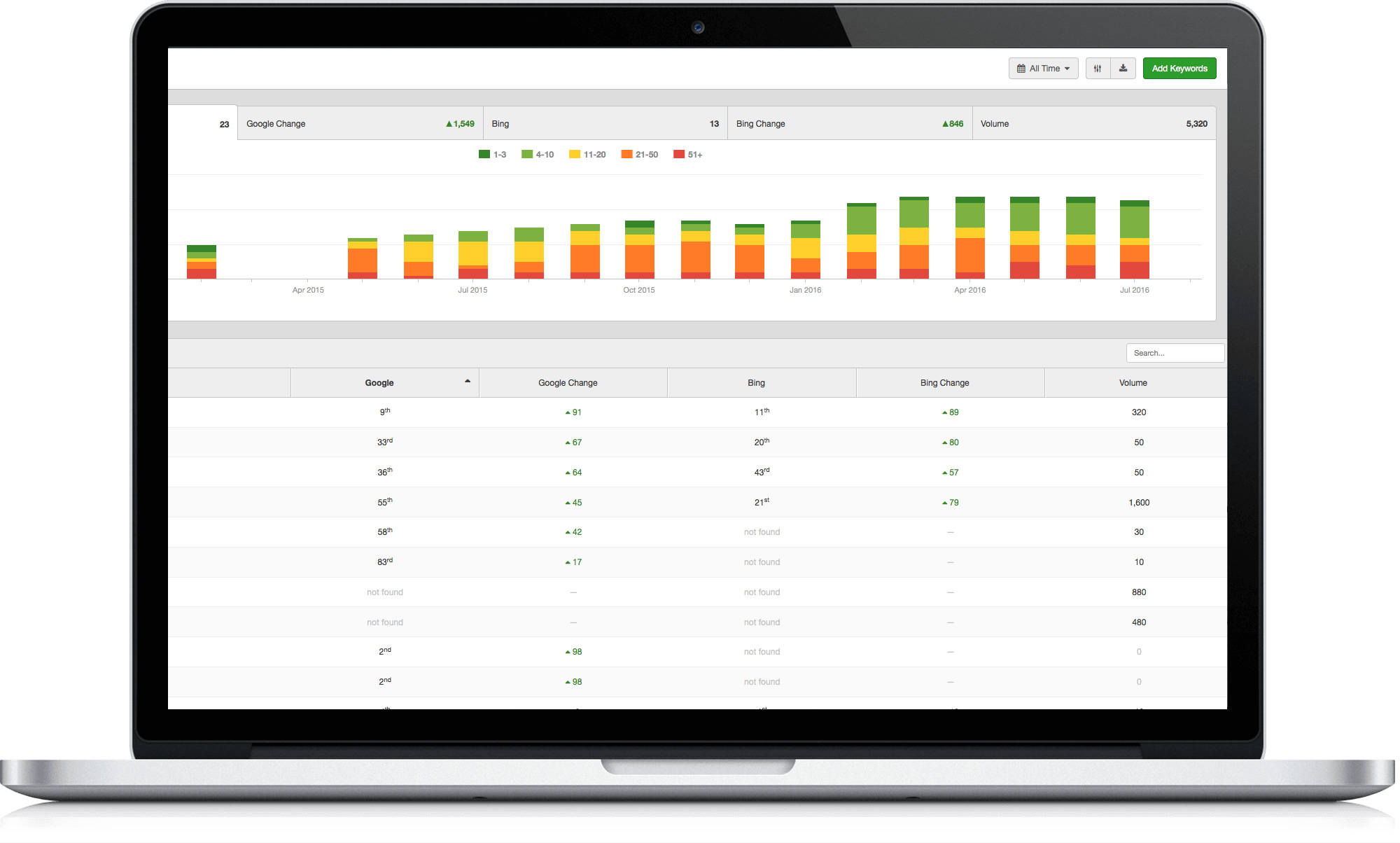

Our reporting dashboard gives you access to key campaign performance data, including lead volumes, bounce rates, lead location, and prospect contact details.

Although not 100% accurate, the digital marketing channels we leverage allow us to be highly targeted with our advertising, giving you a highly qualified stream of monthly enquirers.

MarketingAdviser has built a solid reputation as a profitable partner for financial lead generation. With excellent conversion rates and an experienced skill set in the financial sector, we can free up the time and peace of mind you need to focus on what you do best – running your business and helping clients with their financial needs.

Although we cannot divulge our “secret sauce”, we can tell you that our approach involves leveraging a strategic set of digital marketing channels to generate local, qualified leads for IFAs.

As well as targeting prospects according to their financial needs, in many cases we can target people by age, gender, income, net worth, location, job title and more. This means that we minimise the time you spend sifting through ill-suited prospects, fuelling your sales pipeline and growing your client base. To find out more, contact us for a free consultation on our financial lead generation services.

The kinds of leads we generate encompass:

Our marketing consultants understand that each financial business is different. However, most want to grow their client base and want their financial lead generation to produce tangible, measurable results.

Our process starts by consulting with you to determine your marketing goals, your distinct brand identity and USPs, and the results you want to achieve. From here, we can recommend the appropriate marketing mix and budget to engage in meaningful financial lead generation.

When you sign up as a partner with MarketingAdviser, you gain access to the following: